How to Start an LLC in Florida

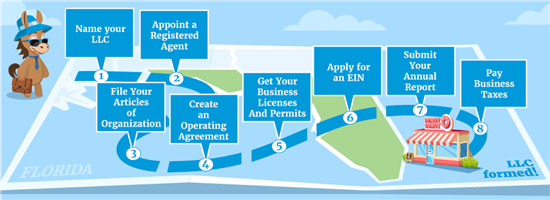

Ready to start an LLC in the Sunshine State? This step-by-step guide explains how to form a Florida LLC, from filing to compliance basics.

|

Forming a Florida LLC can be daunting, especially if it's your first time. But it's easier than you might think.

To start an LLC in Florida, you need to:

There are a few additional things you need to do after these 8 steps, but don't worry. This guide will walk you through each one, from choosing the right name to filing annual reports. So you can form your LLC with confidence.

How to Start a Florida LLC?

|

The steps to starting an LLC in Florida aren't so different from other states. But there are some important reminders you should take note of.

Let's start with the naming requirements.

It costs $125

Name your Florida LLC

Registering a business name is the first step to forming an LLC in Florida. You can choose any name you want as long as it's unique and distinct from other registered businesses in the state.

You can check Florida's online database if the name you want is still available.

Aside from that, your LLC name should also:

- Contain a designator (e.g., LLC or Limited Liability Company)

- Avoid certain restricted words (e.g., bank or trust)

- Not indicate an unlawful, illegal, or criminal business purpose

- Not imply an association with any government agency/organization

Be sure to double-check Florida's complete LLC naming rules. There may be additional restrictions you need to observe.

Don't worry if you can't form your LLC yet. You can reserve your business name first, so you don't lose it to someone else.

Reserving an LLC name in Florida

To reserve a business name in Florida, you just need to write a letter addressed to the Secretary of State. It should include your name, address, and the business name you want to reserve. Don't forget the $25 filing fee.[2]

Make it domain-friendly

Even if you're not planning to create a website soon, choosing a domain-friendly name for your Florida LLC is still a good idea.

Matching your domain with your LLC name will make it easier for customers to recall and find your website. And if you can secure the domain name before registering your LLC, that's even better. This will save you a lot of headaches and hassle later on.

You can use domain registrars like GoDaddy or Domain.com to check if your LLC name is still available as a domain.

If you want to operate under a different name, you'll need to register a fictitious name, also known as a DBA.

Fictitious names for Florida LLCs

In Florida, you can apply for a fictitious name online or through mail. To apply by mail, just fill out an Application for Registration of Fictitious Name. Then submit it to the state's Division of Corporations office with the $50 filing fee.

Once it's approved, you need to advertise it at least once in a local newspaper. It should be in the county where your business is based. But you don't need to submit proof as long as you do it.

Fictitious names in Florida are valid for 5 years and expire on December 31 of the final year.[3] If you want to continue using it, you have to renew it and pay the filing fee again.

Appoint a registered agent in Florida

In Florida, you need to appoint a registered agent before you can form an LLC. The state won't accept your application without one.

A registered agent receives important mail—like state notices and service of process—on your company's behalf.

Anyone can be your Florida LLC's registered agent. You can do it yourself, assign someone else, or use a professional service.

What matters is that whoever you assign meets these criteria:

- A resident or an authorized business in Florida

- Have a physical Florida street address

- Available during regular business hours to receive documents

You also need your registered agent's consent. They must fill out the "Registered Agent Signature" section of the Articles of Organization. If you're filing online, an electronic signature will do.

Keep in mind that there's a $25 designation fee for registered agents in Florida. You pay this with the state filing fee upon submitting your Articles of Organization.

File your Florida Articles of Organization

To form an LLC in Florida, you need to file your Articles of Organization and pay the $125 state fee. These serve as your LLC's application and official paperwork.

You can submit them online through Florida's official portal, Sunbiz. Or you can mail the printed and filled-out form to the Division of Corporations' office along with the filing fee.

New Filing Section

Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314

Your Florida LLC Articles of Organization should include the following information:

- LLC name

- Principal business address

- Mailing address (if different from the principal address)

- Registered agent's name, address, and signature

- Official business purpose

- Management structure

- Effective date (if different from approval date)

- Authorized representative's signature

Once the state approves your LLC, they'll send you a confirmation email or letter, depending on how you filed the paperwork. You'll also receive a Certified Copy and Certificate of Status with the confirmation if you requested them.

In Florida, it typically takes the state 10 to 15 business days to review mailed LLC applications. Online filings are faster, with an average processing time of 5 business days. You can check this page for official status updates.

Create a Florida LLC operating agreement

Florida doesn't require LLCs to have an operating agreement. But it's still strongly advised to draft one.

An operating agreement can reinforce your company's liability protection and help resolve internal conflicts when they arise. Without one, your LLC will be subject to Florida's default rules, which don't always make sense for your business.

For example, profits are split equally among all members by default, regardless of individual contributions. All members also have equal voting power by default.

In your LLC operating agreement, you can include instructions outlining how your business will operate, like:

- Your LLC's formation and dissolution

- Management structure

- Distribution of profits and losses among members

- Members' ownership interests, contributions, and responsibilities

- Transferring membership interests or admitting new members

- Voting rights and decision-making procedures

- Bookkeeping methods

Adding these can create a stronger operating agreement and help keep your LLC running smoothly and efficiently.

Of course, operating agreements are still optional in Florida. So you don't need to file yours with the state. Just keep a copy with your company's records.

Yes, all members need to sign the LLC operating agreement to show that everyone agrees to the terms. Florida law doesn't require notarization, but doing so can help prevent disputes and make it more enforceable in court.

Get Florida business licenses & permits

Unlike other states, you don't need a state-wide general business license to operate in Florida.

But you may need to apply for special permits or licenses, depending on your specific industry and business activities.

Some fields that may need special licenses/permits are:

- Accountants

- Real estate brokers

- Medical professionals

- Contractors and construction

- Engineers, architects, interior designers

You can usually get them from Florida's 3 main licensing agencies:

- Department of Business and Professional Regulation (DBPR)

- Florida Department of Agriculture and Consumer Services (FDACS)

- Florida Department of Health (FDOH)

You can check this list of Florida's state agencies if your business isn't covered by the three mentioned above.

You might also need business licenses or permits from your city or county. Many areas require a general business license called a "business tax receipt" to operate within their jurisdiction.

Make sure you check with your local county's office to see if you need one and where you can apply.

Apply for an EIN

Once your Florida LLC has been approved, you can apply for an Employer Identification Number (EIN). This is necessary for any LLC, even if you don't have any employees.

The only exceptions are single-member LLCs because they can still use the owner's Social Security number (SSN) as their tax ID. But it's still highly recommended that you get a separate EIN, even as a single-member LLC.

EINs are mainly used for tax purposes. But you'll also need it for other LLC requirements, like opening a business bank account.

How to Apply for an EIN

You can apply for an EIN directly with the IRS. If you do it online, you'll receive it immediately after your application is approved.

Some LLC services also offer EIN applications as part of their services. But these usually cost extra, while directly applying with the IRS is free.

Submit your Florida LLC annual report

Florida requires all LLCs to file an annual report to maintain their active status and good standing with the state. The annual report ensures your LLC's record with the state is always accurate, so you can use it to update your company's information.

Your annual report should contain the following details:[5]

- LLC document number

- Business entity name

- EIN (if not yet listed)

- Principal business address

- Mailing address (if different from principal address)

- Registered agent details

- Main LLC owners' information

- Valid email address

You have until May 1st, 11:59 PM EST to file with the state before a $400 late fee applies.[6]

How to file an LLC annual report in Florida

In Florida, you can file the annual report in two ways:

- Online through Sunbiz

- Mail the completed form to the Division of Corporations

There's a $138.75 filing fee[7], which you can pay using a credit card, debit card, or a Sunbiz prepaid account if filing online.

If you're filing by mail, you can pay by check or money order. Don't forget to include the required payment voucher.

After the state processes your annual report, you can download an electronic copy for free.

In Florida, LLCs that don't file their annual reports by the 3rd Friday of September will be dissolved or administratively closed the following Friday.[6] You'll need to apply for reinstatement and pay the associated fees to re-establish your LLC.

Pay Florida business taxes

There are two types of business taxes your LLC needs to be aware of: federal and state.

Here are the ones that apply in Florida:

- Federal income tax

In Florida, a limited liability company doesn't have to pay taxes on a state level. So unless you choose to be taxed like a C-Corp, you only have to worry about federal income taxes.Like in other states, Florida LLCs are considered disregarded entities by default. That means your company will only have to pay income taxes as part of the owner's personal tax returns.

Florida's corporate income tax rate is currently 5.5%.[8] - Self-employment tax

LLC owners aren't paid a salary and are considered self-employed by default unless they're taxed like a corporation.So, they also have to pay self-employment taxes on any profits they receive from the company. The federal self-employment tax rate is currently 15.3%.[9]

- Sales and use tax

Your Florida LLC might also need to pay sales and use taxes if it sells taxable goods or services. The current sales and use tax rate in Florida is 6%[10], with a few exceptions.Take note that some counties may charge a discretionary sales surtax.[11] Double-check with your local county to see if it applies to your LLC. - Reemployment (unemployment) tax

If you hire employees, you might also need to pay Florida's reemployment tax. It's a state requirement for all eligible businesses with employees, but you can choose to pay it on a voluntary basis if yours is exempt.[12]Florida's reemployment tax rate ranges from 0.1% to 5.4%. If you're a new employer, an initial rate of 2.7% applies to the first 10 quarters. After that, the state will reevaluate your history and adjust the rate.[13]

- Industry-specific taxes

Depending on your LLC's business activities or industry, you may need to pay additional taxes to the state.Some examples are the communication services tax, fuel and pollutant tax, and solid waste and surcharge returns fee.

Things to Do After Creating a Florida LLC

After forming your Florida LLC, there are a few other steps you need to take.

Here they are:

Open a business bank account.

Florida LLCs need to open a separate LLC bank account to reinforce their liability protection.

A dedicated business bank account draws a clear line between your personal and business transactions. You won't risk losing personal assets because you can prove you're not using business funds for personal transactions and vice versa.

It also comes in handy when applying for additional funding, like getting a small business loan.

Get business insurance.

Even if you have liability protection as an LLC, it's still a good idea to get business insurance for your company. It will protect your business from financial losses. It can even cover your legal fees and damages in lawsuits.

Plus, depending on your industry and business activities, business insurance might actually be required for your Florida LLC. For example, if you're a construction firm and hire even just one employee, you need to get workers' compensation.[14]

Some other common business insurance for LLCs are:

- General liability

- Commercial property

- Business income

- Professional liability

- Data breach

Create a business website.

A business website is not required. But it's good to have, especially if you want to reach a wider customer base.

A company website will make it easier for potential customers to find your LLC and learn more about it. It can also boost your credibility, especially if you have a strong online presence.

Is It Good to Form an LLC in Florida?

Florida may be best known for its beautiful beaches, warm weather, and family-friendly communities.

But its growing economy and business-friendly climate also make it one of the best states for aspiring entrepreneurs. And an LLC can help you maximize what the Sunshine State has to offer.

If you're still weighing it out, here are the main benefits of starting an LLC in Florida:

- Personal liability protection

An LLC is considered a separate legal entity, so its assets are considered different from your personal ones. That means you don't have to worry about losing your house or car to creditors if your company has financial troubles. - Multiple tax options

As an LLC, you can formalize your business structure without paying additional taxes on your business income. You can report all of your company's profits and losses as part of your personal tax returns.What's more, Florida doesn't charge income taxes at the state level. But if you want the ability to sell company shares to investors, you can always opt for a C- or S-Corporation tax status instead.

- Fewer annual requirements

Starting and maintaining an LLC is easier and simpler because of the fewer requirements. In Florida, the main regular requirement you need to comply with is the annual report. No need to hold annual meetings or create company bylaws like corporations. - Better credibility and flexibility

Starting an LLC in Florida lets you retain a simple management structure while boosting your company's credibility. This can make it easier to get additional business funding without giving up the flexibility.

However, there are downsides, too. For example, if you want to add another member, existing LLC members typically need to approve the change. And you need to update your LLC operating agreement to reflect the new changes.

You also need to comply with regular requirements to keep your good standing, like filing your annual report and paying taxes.

- Property tax on business inventories

- Sales and use taxes on Florida-made goods for export

- Sales or use tax on electricity co-generation

Florida also offers plenty of incentives and accessible funding to its local small businesses, making it a great place to form an LLC.

Ways to Start an LLC in Florida

You can start an LLC in Florida in three ways, namely:

Do it yourself

Doing it yourself is the cheapest way to start an LLC in Florida since you just have to worry about the state fees. If you have simple LLC needs or if you're comfortable handling paperwork, this option can help you minimize the costs.

However, the downside is that you'll be doing everything yourself, including filling out the forms, making sure the information's correct, and filing them with the state.

Use a formation service

You can hire an LLC service if you're not sure how to start an LLC in Florida yourself. They can handle the entire process for you, usually for an additional fee.

Although it costs more than doing it yourself, this option can give you peace of mind since most LLC companies have accuracy and money-back guarantees. Most of them also offer other services to help run your LLC, like registered agents and annual report filing.

Hire a lawyer

Working with an attorney to start your LLC is a good option if your business has more complex needs. A business lawyer will have the necessary expertise in the state's laws and regulations to keep your company compliant.

The downside is the cost. You may have to pay more than expected since professional fees will depend on the lawyer or law firm.

LLC Formation Service - $39 + State Fees

- Privacy by Default (use their address instead of yours)

- Files all paperwork with the state

- 1 year registered agent included

- Free LLC Operating Agreement

- Never sells your data. Ever.

Starter - $0 + State Filing Fees

- 1 year of Worry-Free Compliance (renews at $199/year)

- Standard filing speed

- 100% accuracy guaranteed

- Other services are available with additional costs

Start Your LLC for $0 - Just Pay State Fees

- Get step-by-step guidance to form your LLC

- Check business name availability

- LLC formation processing within 14 business days

- Business coaching program (tax, compliance, marketing)

- Invoicing and bookkeeping (30-day trial)

Florida LLC FAQs

- Can a non-resident or foreigner form a Florida LLC?

Yes, non-residents and foreigners can form an LLC in Florida. The state doesn't require LLC owners to be US residents or citizens as long as they comply with the requirements. However, your registered agent must be physically based in Florida.

- How do I start a foreign LLC in Florida?

To start a foreign LLC in Florida, you need to submit an Application for Authorization to Transact Business in Florida. You also need to submit a Certificate of Existence (aka Certificate of Good Standing) and pay the $100 filing fee.

- How do I change my registered agent in Florida?

To change your Florida LLC's registered agent, just file a Statement of Registered Agent/Office Change and submit it to the state's Division of Corporations office with the $25 filing fee.

- How to correct a mistake when filing a Florida LLC?

If there are mistakes in your LLC's documents, you need to file a Statement of Correction with the Florida Division of Corporations office and pay the $25 filing fee.

- How do I dissolve my Florida LLC when I'm done?

To dissolve a Florida LLC, you need to file your Articles of Dissolution with the state's Division of Corporations office. You can do this via mail or online using their portal. You also need to pay a $25 filing fee. They accept payment via credit card, debit card, and a Sunbiz prepaid account.

What the Experts Say

CreditDonkey asked a panel of industry experts to answer readers' most pressing questions. Here's what they said:

Bottom Line

Florida is a great place to start an LLC. But whether you take the DIY route or use an LLC service, it's important to familiarize yourself with the process. That way, your application goes as smoothly as possible.

There are differences in how you apply compared to other states. But these 8 steps should help paint the picture of what to expect. You can set up your LLC in Florida in no time.

References

- ^ Florida Division of Corporations. LLC Fees, Retrieved 01/15/2026

- ^ Florida Department of State. Limited Liability Company Fees, Retrieved 01/15/2026

- ^ Florida Department of State. Florida Fictitious Name Registration, Retrieved 01/15/2026

- ^ Internal Revenue Service. Get an employer identification number, Retrieved 01/15/2026

- ^ Florida Division of Corporations. Annual Report Instructions, Retrieved 01/15/2026

- ^ Florida Division of Corporations. File Annual Report, Retrieved 01/15/2026

- ^ Florida Division of Corporations. Limited Liability Company Fees, Retrieved 01/15/2026

- ^ Florida Department of Revenue. Corporate Tax, Retrieved 01/15/2026

- ^ Internal Revenue Service. Self-Employment Tax, Retrieved 01/15/2026

- ^ Florida Department of Revenue. Florida Sales and Use Tax, Retrieved 01/15/2026

- ^ Florida Department of Revenue. Discretionary Sales Surtax, Retrieved 01/15/2026

- ^ Florida Department of Revenue. Florida Reemployment Tax, Retrieved 01/15/2026

- ^ Florida Department of Revenue. Reemployment Tax Rate, Retrieved 01/15/2026

- ^ Florida Department of Financial Services. Coverage Requirements, Retrieved 01/15/2026

- ^ Select Florida. Business Climate, Retrieved 01/15/2026

Write to Alyssa Supetran at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

|

|

|